UNEMPLOYMENT AND WAGE LOSSES DURING THE COVID-19 PANDEMIC

CARES Act Reemployment Assistance

A Resource Guide

On December 27, 2020, the president signed into law the Continued Assistance for Unemployed Workers Act of 2020 (Continued Assistance Act) which extends some federal unemployment programs authorized by the CARES Act. Please review those changes and any updates to SD DOL process at https://dlr.sd.gov/ra/cares.aspx

Unemployment Insurance Provisions of the CARES Act Summary

President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act into law on March 27, 2020. Title II, Section A of the CARES Act, titled the “Relief for Workers Affected by Coronavirus Act (RWACA),” provides for a significant expansion of unemployment insurance benefits for persons out of work due to the COVID-19 crisis. Major aspects of the RWACA are described below.

Pandemic Unemployment Assistance for Persons Otherwise Ineligible for Unemployment Benefits

Section 2101 of the RWACA creates a temporary Pandemic Unemployment Assistance (PUA) program effective from January 27, 2020 to December 31, 2020, which covers individuals out of work who would not otherwise be eligible for unemployment insurance benefits (e.g., self-employed individuals, independent contractors, gig workers and persons with an insufficient work history) who are unable to work as a direct result of the COVID-19 crisis. Persons covered under PUA will be eligible for unemployment benefits as long as they can self-certify that they are unemployed, partially unemployed, or unable or unavailable to work because:

- They have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 and seeking a medical diagnosis;

- A member of the individual’s household has been diagnosed with COVID-19;

- They are providing care for a family member or member of their household who has been diagnosed with COVID-19;

- A member of their household for whom they have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of the COVID-19 public health emergency and, as a result, they are unable to work;

- They are unable to reach the place of employment because of a quarantine imposed as a direct result of the COVID-19 public health emergency;

- They are unable to work because a health care provider has advised them to self-quarantine due to concerns related to COVID-19;

- They were scheduled to start work but do not have a job or are unable to reach the job as a direct result of the COVID-19 public health emergency;

- They have become the breadwinner or major support for a household because the head of household has died as a direct result of COVID-19;

- They have quit their job as a direct result of COVID-19;

- Their place of employment is closed as a direct result of the COVID-19 public health emergency; or

- An individual meets any additional criteria established by the Department of Labor for unemployment assistance under the RWACA.

Individuals who are able to telework with pay or are receiving paid sick leave or other paid leave benefits are ineligible for assistance under PUA.

Emergency Temporary Increase in Unemployment Compensation Benefits

Section 2104 of the RWACA provides for an additional payment of $600 per week in unemployment insurance benefits to all recipients of unemployment insurance, including those covered under PUA, through July 31, 2020. The $600 payment is on top of any unemployment benefits an unemployed worker might otherwise be entitled to under federal or state law. In some cases, the combination of regular unemployment benefits and the additional $600 in Federal Pandemic Unemployment Compensation may exceed an individual’s weekly wage while working.

Temporary Full Funding of the First Week of Unemployment Benefits

Section 2105 of the RWACA creates funding to fully reimburse states that provide unemployment benefits for the first week of unemployment without a one-week waiting period through December 31, 2020. New York State had eliminated its one-week waiting period before enactment of the RWACA.

Emergency Extension of Unemployment Compensation Benefits

Section 2107 of the RWACA provides an additional 13 weeks of unemployment benefits, through December 31, 2020, to individuals who otherwise would be ineligible for benefits because they have exhausted the rights to regular unemployment compensation under applicable federal or state law.

Emergency Unemployment Relief for Governmental Entities and Nonprofit Organizations

Section 2103 of the RWACA establishes a program for the U.S. Department of the Treasury to pay states to reimburse nonprofits, governmental entities and Indian tribes for half the cost they incur to pay unemployment benefits through December 31, 2020.

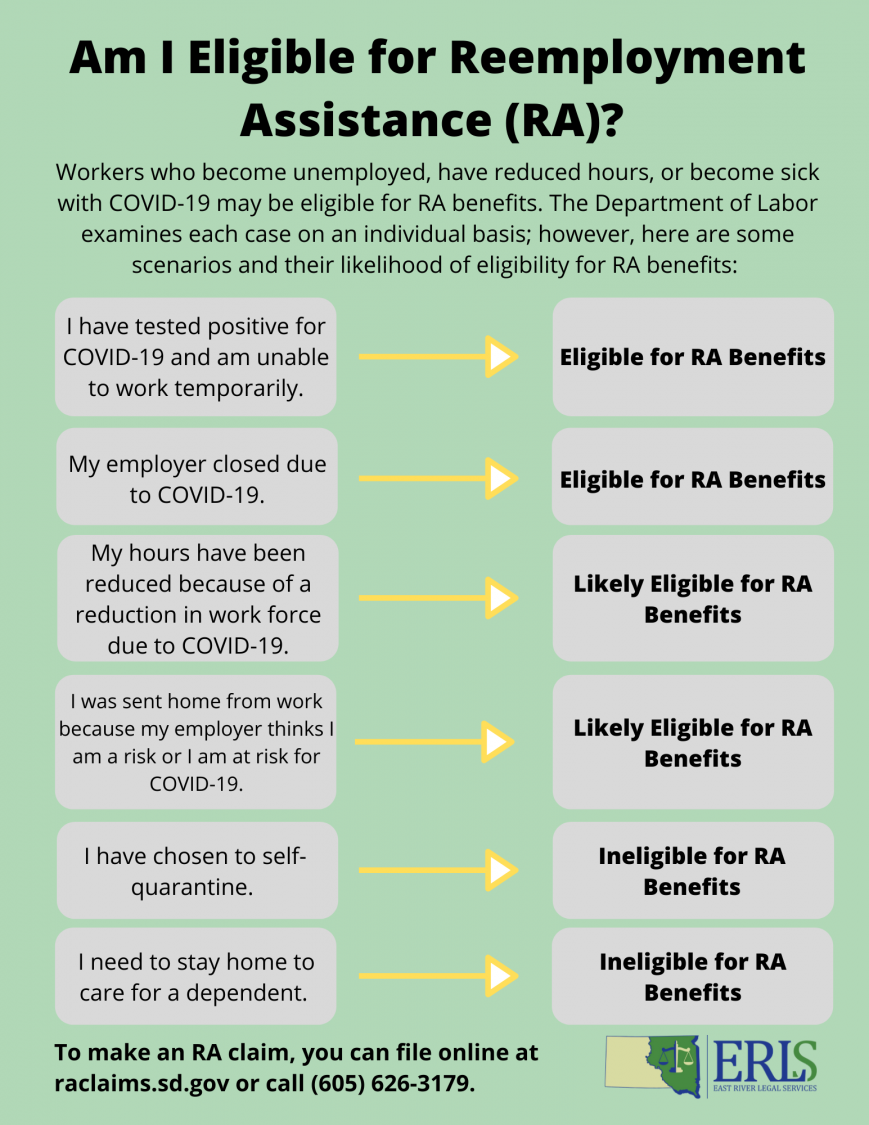

Eligibility & How to File

ELIGIBILITY CHECKER

https://dlr.sd.gov/ra/publications/ra_covid_19_eligibility_checker.pdf

SD Benefits and Eligibility Fact Sheet

https://dlr.sd.gov/ra/publications/rabenefits_eligibility_factsheet.pdf

Federal Eligibility Factsheet

https://oui.doleta.gov/unemploy/docs/factsheet/UI_Program_FactSheet.pdf

Things to Know Before You File

https://dlr.sd.gov/ra/individuals/file_claim.aspx

Reemployment Benefits FAQs

https://dlr.sd.gov/ra/individuals/faq.aspx

Reemployment Assistance Eligibility Determinations (Hypothetical Scenarios)

https://dlr.sd.gov/ra/publications/ra_covid_19_eligibility_determinations.pdf

SDCL Title 61 Reemployment Assistance (SDCL 61-6 covers reemployment assistance benefits)

https://sdlegislature.gov/Statutes/Codified_Laws/2077726

ARSD 47:06 Reemployment Assistance (47:06:05 covers appeals)

https://sdlegislature.gov/Rules/Administrative/19393

Appeals & Waivers

SD DOL Appeals Information

https://dlr.sd.gov/ra/individuals/appeals.aspx

SD DOL Overpayments Information

https://dlr.sd.gov/ra/overpayments/default.aspx

Overpayments FAQs

https://dlr.sd.gov/ra/overpayments/faq.aspx

How to request a waiver (on FAQ page):

The overpayment notice you received by mail indicates your waiver and appeal rights. Please read the notice carefully and note the date it was sent. Waivers and appeals can be accepted if made within 15 days after the notice was sent. You must appeal in writing by mailing your appeal letter to the following address or faxing it to the number below. Your appeal must include your file number and the reason for the appeal. A waiver request needs to be submitted separately from an appeal request within the 15 day timeframe.

South Dakota Department of Labor and Regulation

Reemployment Assistance Benefits Appeals

P.O. Box 4730

Aberdeen, SD 57402-4730

Fax: 605.626.2322

Consolidated Appropriations Act, 2021 Waiver Language

State agencies may waive repayments if it determines “the payment of such pandemic unemployment assistance was without fault on the part of any such individual; and such repayment would be contrary to equity and good conscience.″ (Page 1932 of Act)

A note from one of our pro bono volunteers on utilizing “contrary to equity and good conscience” for waiver: SDCL 61-6-42 is the state equivalent of Section 2104. My view is that these statutes allow you to make a straight up argument for justice – in so many of these cases this is the first time a person has ever applied for unemployment, and their employer told them to apply. Now they are being told by DOL they are potentially subject to criminal prosecution for fraud because they applied for and received benefits. My view is these statutes allow you appeal to the ALJ for basic justice.

US DOL Overpayment Waiver Guidance

https://oui.doleta.gov/unemploy/overpay_waivers.asp

FORM TO APPEAL

https://sd.gov/eformssecure/agencyforms/dlr/uiappeals/e0806v2-dol-uid_a-1.html

APPEALS BROCHURE

https://dlr.sd.gov/ra/publications/appealsbrochure.pdf

ARSD 47:06 Reemployment Assistance (47:06:05 covers appeals)

https://sdlegislature.gov/Rules/Administrative/19393

Legal Resources

Legal Services online application (ERLS, DPLS, A2J)

SD Free Legal Answers (Ask questions to an attorney online)

https://sd.freelegalanswers.org/

State Bar Lawyer Referral (do not income qualify for legal aid, retain and pay private attorney)

National Employment Law Project – COVID-19 Resources for Unemployed & Frontline Workers

https://www.nelp.org/campaign/covid-19-unemployed-and-frontline-workers/

US DOL Guidance & FAQs

https://www.dol.gov/coronavirus/unemployment-insurance

Reemployment Assistance Guidance for Businesses

https://dlr.sd.gov/ra/businesses/documents/covid_19_ra_guidance_busines…

Other Updates

DOL Press Releases

https://dlr.sd.gov/news/default.aspx

Beware of Scams (Phishing/Fraud Alerts)

https://www.oig.dol.gov/public/Fraud_Alert_Graphic_UI_Phishing.pdf

https://dlr.sd.gov/ra/publications/dol_oig_ui_fraud_alert_041620.pdf

DOL Funding $100 Million to States to Combat Fraudulent Unemployment Payments (SD received $1,020,600 for PUA and $194, 400 for PEUC)

https://www.dol.gov/newsroom/releases/eta/eta20200901